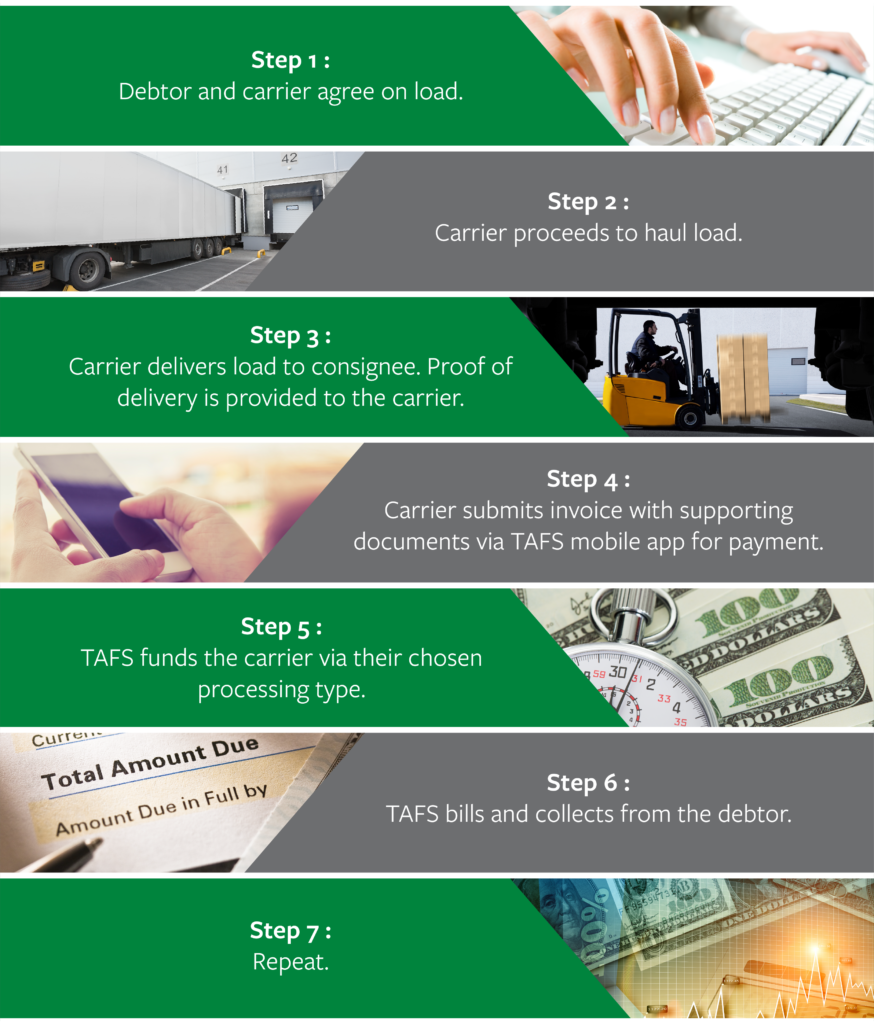

How TAFS Factoring Works

TAFS is a trucking factoring company that provides owner-operators accounts receivable financing, a.k.a. factoring. Factoring has become extremely common in the trucking business. It is when your company’s accounts receivable are converted into cash by selling the freight bill of lading or outstanding invoices to us, the factor. Rather than waiting for your customers (the shipper or freight brokers) to remit payments based on 30, 60, or 90-day terms, we quickly advance a percentage of the invoice to your business. This steady cash flow is vital for small businesses and allows working capital to fund your critical expenses such as payroll, fuel, insurance, and maintenance. TAFS is also able to offer same-day funding with some of the best factoring rates you will find. You also don’t need to settle for next-day funding. Using our transportation factoring program, you can even get your money in as little as one hour. Or maybe you are in need of a quality and free fuel card, a line of credit, or the ability to see the industry credit score for clients before you haul. We can do that too!

Why Businesses Factor

Those in the trucking industry have more than likely at least heard of the term “freight factoring” or “truck factoring” by now. Maybe even “invoice factoring,” as that is what we are really dealing with, the purchasing of unpaid invoices to get you paid for the invoice amount. It tends to get thrown around quite a bit these days and has gained a name for itself in the industry over the past several years. However, even those who have heard of the term factoring, many truck drivers and business owners still do not understand precisely what it is or how it all works. This is especially true for those who are new to the world of trucking in general, let alone specifically that of trucking factoring.

Previously, truckers would grab a load from a load board or their dispatching service, then were forced to float debts and rely heavily on traditional banks for loans to cover their business expenses until they received payment for the loads they ran. This is because you may not get paid for that invoice value until 30, 60, or even 90 days out. Traditional banks try to help freight companies, however, are not solely focused on the trucking industry, therefore, rarely have plans that truly benefit the needs of truckers. Worse than this, many would even turn to credit cards to cover them in these uncertain times.

There are many different types of factoring programs from various providers, and choosing the correct one for your business is an important decision.

Conventional borrowing is difficult to secure, especially for new or rapidly expanding businesses. Factoring does not create debt or require additional collateral and can generate cash flow quickly. With TAFS, once clients establish a factoring agreement, they can get their cash advance within 1 hour of submitting a freight invoice. You will wait a lot longer for your money with a traditional loan. You can even easily accomplish this through the TAFS mobile app.

Speed up cash flow.

An alternative to restrictive bank financing.

Eliminate the need for back-end office personnel.

Reduce debt on your balance sheet.

Why Choose TAFS Factoring Services?

As one of the best factoring companies in the industry, TAFS knows the transportation industry firsthand and came into being out of seeing the need for a new approach to factoring services in trucking. No matter if you are running single loads or have secured long-term contracts, TAFS understands the needs of startup trucking companies as well as the expectations of the industry, and we use that knowledge to provide our clients with a unique and understanding approach to factoring. You will not get run through the false hopes of a “non-recourse factoring” that only amounts to cleverly written small print. That is why we do not hide our recourse factoring approach. You will get the upfront truth and fair business every time. TAFS proudly stands out from any freight factoring company through the level of understanding and expert knowledge our team brings to the table. Our trucking experts know the business and what truckers are dealing with, and the services they need to succeed. Beyond the funding options and great pricing, TAFS has a strong lineup of benefits and strategic partnerships geared towards our client’s success. While other businesses have entire office staff working hard to push the company forward, for many trucking companies, all that pressure and responsibility falls on the guy driving the truck; It doesn’t have to, though. Through strategic partners like TAFS, you can set your trucking company up for success while taking a fair amount of the burden off of your shoulders. From fuel cards with amazing fuel discounts, free credit checks, and access to a credit line for fuel advance needs to excellent back-office support and more, TAFS has you covered.

Why wait when you can get paid today? Call us today to get the factoring process started for your trucking company! (913)393-6110